News & Insights / Λnβro Portfolios Celebrate 1st Anniversary with All-Time Highs on Mesh

Λnβro Portfolios Celebrate 1st Anniversary with All-Time Highs on Mesh

Disciplined strategies, sector diversification, and blue-chip selections have been key to performance.

- October 26, 2025

- by Mesh

It’s been one year since Λnβro’s first three portfolios were listed on Mesh, and the milestone couldn’t have come at a better time. Each portfolio has reached an all-time high on Mesh this October, demonstrating the strength of disciplined, high-conviction investing.

As highlighted in Λnβro’s quarterly note, resilience and diversification matter more than ever in unpredictable markets. With performance ranging from +10.2% to +22.26%, these portfolios demonstrate how a structured approach can deliver consistent results, even amid global uncertainties.

All returns mentioned are in ZAR. For the international context, the Rand has strengthened by 8.2% against the USD YTD, meaning the USD-adjusted returns are even more impressive. This dynamic also opens up opportunities for investors looking for a rand hedge, particularly those wanting exposure while the dollar remains weak.

Let’s take a closer look at the three Λnβro’s Capital funds since their listing on Mesh.

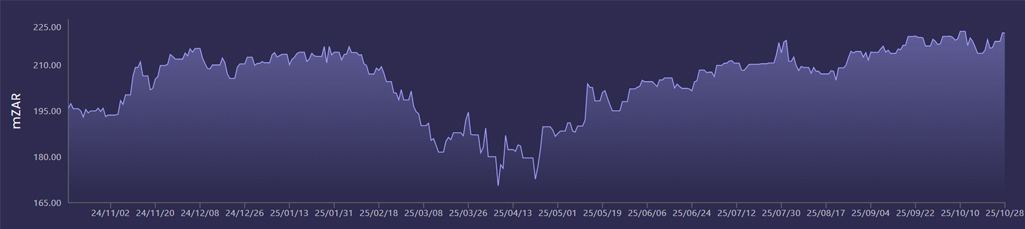

Λnβro Unicorn Global Equity AMC

Listing Price | All-Time High | Growth |

|---|---|---|

mZAR 195.81 (Oct 2024) | mZAR 220.97 (12 Oct 2025) | +12.85% |

The Λnβro Unicorn Global Equity portfolio offers investors exposure to some of the most innovative and high-performing global companies. Its one-year performance highlights the benefits of a diversified portfolio focused on long-term growth.

Monetary policy uncertainty reinforces the importance of well-diversified portfolios like Unicorn Global Equity, which are designed to perform across different market conditions.

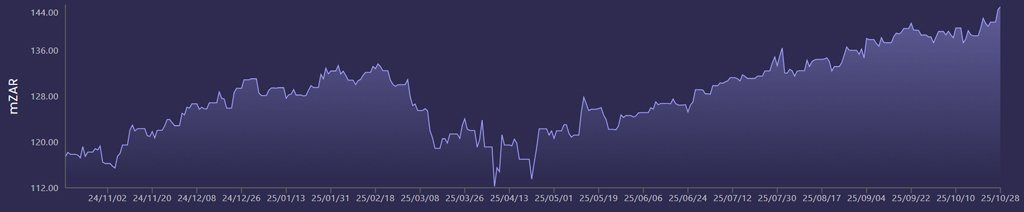

Λnβro World’s Biggest BRNDZ AMC

Listing Price | All-Time High | Growth |

|---|---|---|

mZAR 117.46 (Oct 2024) | mZAR 143.61 (28 Oct 2025) | +22.26% |

The Λnβro’s World’s Biggest BRNDZ portfolio has delivered the strongest gains over the past year. By investing in global brand leaders across multiple sectors, it has combined diversification with high-performing assets, rewarding investors who stayed the course.

With fewer companies citing ‘inflation’ and ‘uncertainty’ as potential headwinds according to Λnβro’s quarterly note, the stability in corporate earnings has supported the BRNDZ portfolio’s performance.

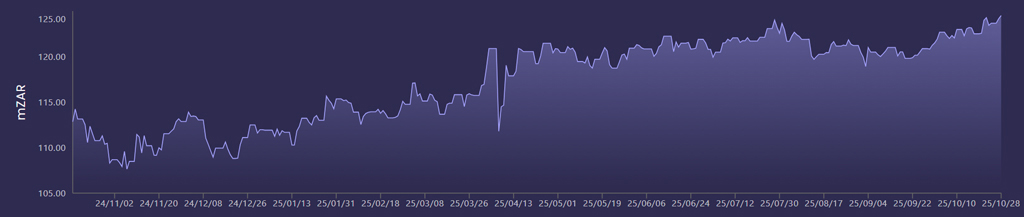

Λnβro Dynamic Compound AMC

Listing Price | All-Time High | Growth |

|---|---|---|

mZAR 112.58 (Oct 2024) | mZAR 124.51 (22 Oct 2025) | +10.33% |

Since its Mesh debut, the Λnβro Dynamic Compound portfolio has steadily climbed, offering investors a combination of growth and stability. Its focus on compounding returns while managing risk has helped it navigate unexpected market shifts.

By holding a mix of high-quality global companies and balancing exposure, the fund is designed to absorb shocks like sudden tariff threats without large drawdowns.

Want to dive deeper?

Read the full Λnßro Capital Investments’ quarterly newsletter where Chief Investment Officer, Craig Antonie, considers a steadier quarter and shifts shaping markets into year-end.

Meet Λnβro’s TITANS — the powerhouse portfolio launched on Mesh in June 2025. It’s a strong, stable foundation for a model portfolio, offering balanced exposure to the most dominant companies across all 11 S&P 500 sectors.

TITANS is all about balance. Unlike traditional ETFs, the TITANS portfolio uniquely avoids concentration risk by equally weighting each sector leader, with annual rebalancing to adapt to market shifts. It’s a disciplined, high-conviction US equity strategy built to outperform the S&P 500 with lower risk.

Ready to explore Λnβro’s portfolios?

Whether you’re looking for growth, diversification, or a stable equity allocation, Λnβro’s funds offer solutions tailored to your needs.

View the funds on Mesh.trade to see which one fits your investment strategy.

* This article is for information only and does not constitute investment advice, a solicitation or an offer to buy or sell any financial product.

Tags

27Four AltFi Blockchain Capital Markets Capital Markets of the Future Commodity Markets Crypto Markets DeFi DieMos ETN Financial Markets FSP Fully backed stablecoin Global Markets Gold Investing Investment Mesh mZAR Open to all PreciousMetals Private Equity Regulation Secondary Market Silver Smart Assets Tokenisation TradFi Yield-bearing stablecoin yZAR ZAR stablecoin

- Blockchain, Capital Markets, Capital Markets of the Future, Global Markets, Investing, Investment, Mesh, Open to all, Smart Assets, Tokenisation

Want to stay in the know on upcoming events and seminars?

Newsletter Sign Up

For more press information, please contact:

Connie Bloem, Product owner of Mesh:

hello@meshtrade.co / +1 604 671 4515