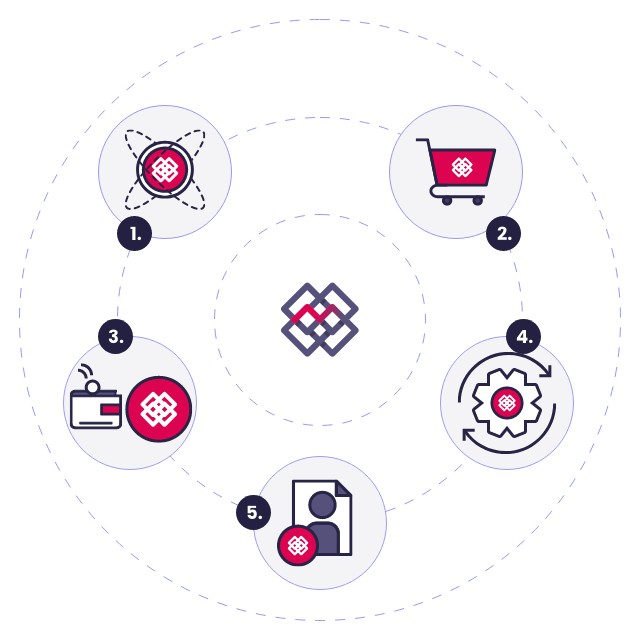

Mesh has compressed the 5 main functions of the capital markets into one elegant flow:

- Asset Origination, Issuance, and Tokenisation.

- Primary and Secondary Market Mechanisms for the Distribution and Trade of all Assets.

- Full and Final Settlement Mechanisms – both Cash and Security token.

- Lifecycle Management and Asset Servicing – such as coupon calculations, payment, and maturity management.

- Ownership Verification through the platform’s Asset Registry.