News & Insights / The Great Gold Bull Market of 2025 and Gold’s Next Move in ‘26

The Great Gold Bull Market of 2025 and Gold’s Next Move in ‘26

Gold dominated markets in 2025. Troygold’s Dane Viljoen unpacks the forces behind the rally, why gold is now a core portfolio diversifier, and what upside and downside scenarios could shape 2026.

- January 22, 2026

- by Mesh

Around this time a year ago, gold had just come off its record highs of about $2,800/oz as Donald Trump was elected for his second term as U.S president. Gold per troy ounce was priced at $2,640/oz, having gained 29% from $2,040/oz at the start of 2024.

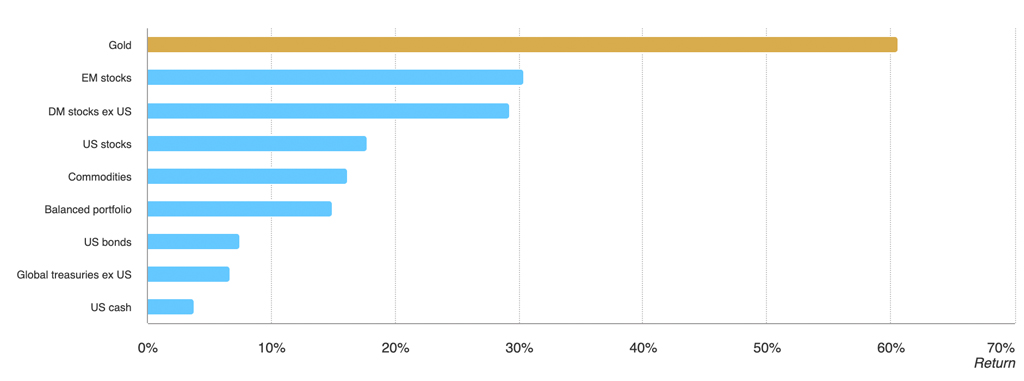

One year later, gold has now also just come off its new record high of $4,620/oz, having gained over 60% from $2,650 at the beginning of 2025. What a run! The yellow money outperformed all other asset classes, beating U.S equities at 18%, U.S Bonds at 7%, and emerging market equities at 30%.

Graph: YTD return for gold and key asset classes in USD, as at 4 Dec 2025

Source: World Gold Council, Gold Outlook 2026.

The right question seems to be – what’s happened in 2024, 2025, and what then can we expect from 2026?

What’s been Happening

Sovereign debt – Global public debt has rocketed from US$30 trillion in 2008 to nearly $100 trillion in 2025 – which today equals 93% of global GDP [IMF]. The Financial Crisis of 2008 and the COVID-19 pandemic of 2020 provided governments reason to dramatically increase fiscal spending and borrowing. U.S public debt increased by $2.5 trillion in 2025 and amounts to roughly $38.5 Trillion today, with the trajectory set to continue with the current administration. Debt-to-GDP now sits at over 120% in the U.S, with China at 96% and the UK at 104%.

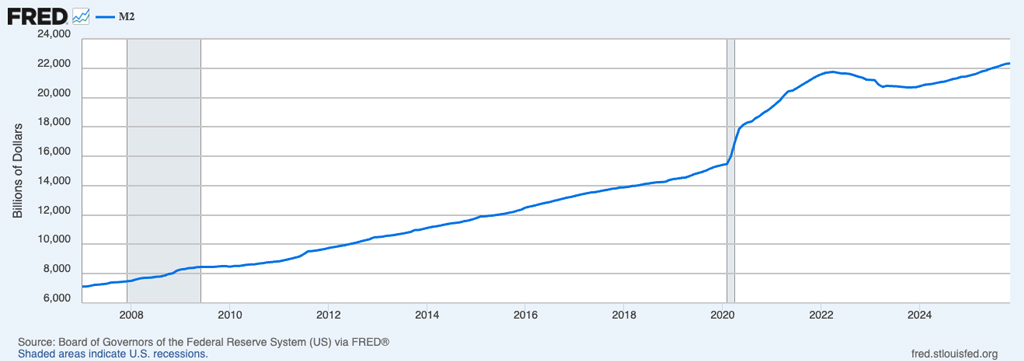

To meet these funding needs, governments debased their currencies by drastically expanding their money supply. Effectively, this transfers the value locked up in citizens’ savings to government’s coffers. To illustrate this, a graph of the U.S. M2 Money supply (spending and savings monies) shows an increase of more than 30% of Dollars in the last 5 years.

Source: FRED – Federal Reserve Bank of St. Louis

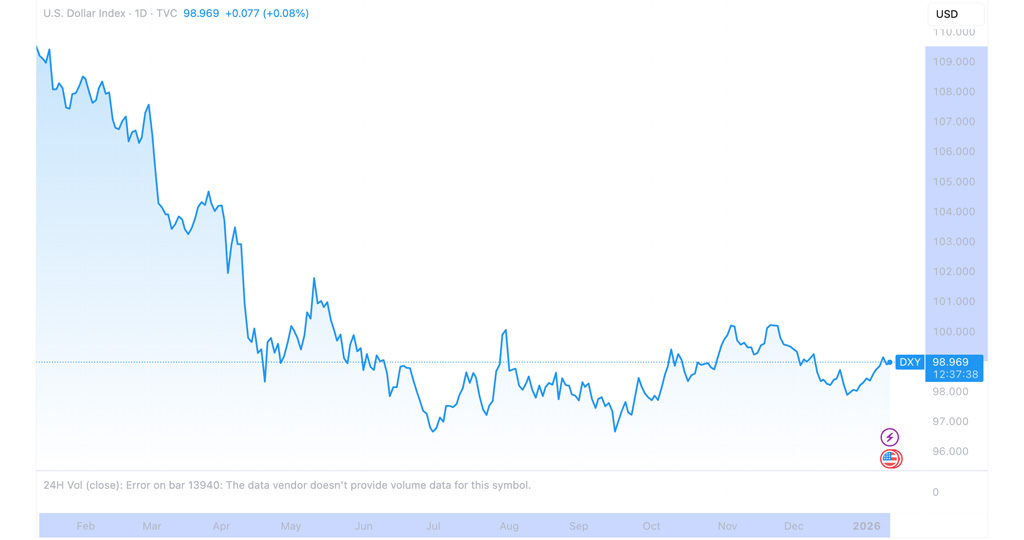

U.S Dollar weakness – Last year, the current American administration assaulted their trading partners by way of punitive tariff increases. This, coupled with the increased weaponisation of the Dollar by way of economic sanctions and a structural rise in bond yields, has pushed nations and their central banks to de-dollarise their reserves. They’ve purchased gold and alternative trading currencies (energy markets in particular) – an insurance measure to hedge against Dollar value loss and market volatility.

Market expectations are that U.S government spending deficits will remain structural. The result – the Dollar Index (DXY) weakened by c.10% in 2025.

Source: TradingView, as at 13.1.2026

Geopolitical Wars, not Tensions – 2025 saw tremendous geopolitical uncertainty and fighting. The world seemed split according to countries aligned with either the American axis or the Chinese-Russian axis. Russia has continued its invasion of Ukraine and resisted various peace deal attempts. Israel continued its attempted scourge of Hamas in Gaza. The U.S bombed Iranian nuclear sites, militant groups in northern Nigeria, invaded Venezuela and captured its president, Maduro. China has committed itself to the reunification of Taiwan, conducting large-scale military exercises around the chip-manufacturing island. This uncertainty has fueled demand for gold as the primary safe-haven asset.

What’s Happening to Gold

Gold is majorly a monetary asset, so the main factor determining its price isn’t industrial supply and demand, but rather investment demand. This is made up of bullion purchases (gold bars, coins, ETFs), Jewellery demand (India, China, the Middle East), Central Bank buying, and then from a macro perspective – the real rate of interest in main currencies, particularly the U.S rate.

In 2025, it was mainly this investment demand that drove the gold price rise. Albeit we don’t have final annual figures, demand in the first three quarters for bars and coins increased by more than 10% year-over-year, and gold ETF demand showed net gains of 748.9t (+26%). This accounted for 50% of gold demand last year, which is up from usually a third. So the investment community were stacking up!

In our view, gold has now gone mainstream as a portfolio diversifier and optimiser – not just as the preeminent inflation hedge. Its negative correlation with traditional assets and its high returns have made it into standard portfolios as a key diversifier. This is spurred on even more with US bonds losing their risk-free rate shine and western equity markets at ultra-high P/E valuations (especially amongst tech stocks).

In 2025, Ray Dalio stated that gold must be 5-15% of a portfolio as it hedges against debasement risks. Similarly, Morgan Stanley asset management published a report advising that the standard 60/40 equities/bond portfolio should now be revised to a 60-20-20 portfolio, with gold at 20%.

So, what happens in 2026?

On the downside – There is a large amount of risk premium priced into the gold price at present, mostly attributable to uncertainty in geoeconomics, which could deflate the price somewhat if the situation improves. In this scenario, pundits say:

Stonex Group – “We are looking for gold to end 2026 in the region of $3,800 … as we believe that while there is still investor appetite, the massive increases in price last year are pricing in a lot of market risk premium.”

On the upside, we again looked to pundits and expert institutions:

World Gold Council: “Our analysis shows that, in this environment, gold could rise 5% – 15% in 2026 from current levels, depending on the severity of the economic slowdown, and the speed and magnitude of the rate cuts.”

Goldman Sachs: “Goldman Sachs (GS) expects gold prices to rise 14% to $4,900 per ounce by December 2026 under its base case, according to a note published on Thursday. The bank added that there were upside risks to this forecast, citing the potential for broader diversification demand from private investors.” [Yahoo finance]

Explore the TroyGold coin on Mesh now.

Let’s go Gold in ‘26,

Dane Viljoen

Co-Founder and CRO at Troygold

Tags

27Four AltFi Blockchain Capital Markets Capital Markets of the Future Commodity Markets Crypto Markets DeFi DieMos ETN Financial Markets FSP Fully backed stablecoin Global Markets Gold Investing Investment Mesh mZAR Open to all PreciousMetals Private Equity Regulation Secondary Market Silver Smart Assets Tokenisation TradFi Yield-bearing stablecoin yZAR ZAR stablecoin

- Blockchain, Capital Markets, Global Markets, Gold, Investing, Investment, Mesh, Open to all, Smart Assets, Tokenisation

Want to stay in the know on upcoming events and seminars?

Newsletter Sign Up

For more press information, please contact:

Connie Bloem, Product owner of Mesh:

hello@meshtrade.co / +1 604 671 4515