Finding Like Minds

One of the periodic pleasures of building a company based on an expansive vision of the future is occasionally coming across others who see the same things through their telescopes as we do. Competitors certainly do, but of course that often requires adjustments to offensive and defensive business postures. More satisfying is the carefully assembled research by consultancies and think-tanks which dovetails perfectly with what we do every day. It is always a welcome affirmation.

We came across one recently. It was a report written by the German company Porsche Consulting. In case you are wondering, they were indeed the internal consulting arm of the sports car company, advising on all manner of vehicle related matters within Porsche. They were spun out as an independent consultancy in 1993, initially in the automotive industry, but now widely spread across many sectors, with 950 consultants employed globally.

A few weeks ago they dropped a 26-page report titled “Security Tokenization – How to unlock hidden value by moving stocks, bonds, and funds on the blockchain”

So naturally we looked, as we always do when knowledgeable people write about our sector. The extensively footnoted report read like it had been commissioned and approved by us. Of course, much of the content was very familiar; it is embedded in our corporate DNA. But there was also some clever aggregation of some lesser-known data which we want to share.

The paper begins with a concise articulation of the advantages of security tokenisation – the widening of capital sources for issuers, the broader investment opportunities for buyers, the advantages of tokenisation (security, speed, divisibility, security, trading, tracking, settlement, etc.) These are core songs off our hymn sheet, we sing them often.

But where the paper gets really interesting is in the areas of cost, efficiency and regulation.

Cost and Efficiency

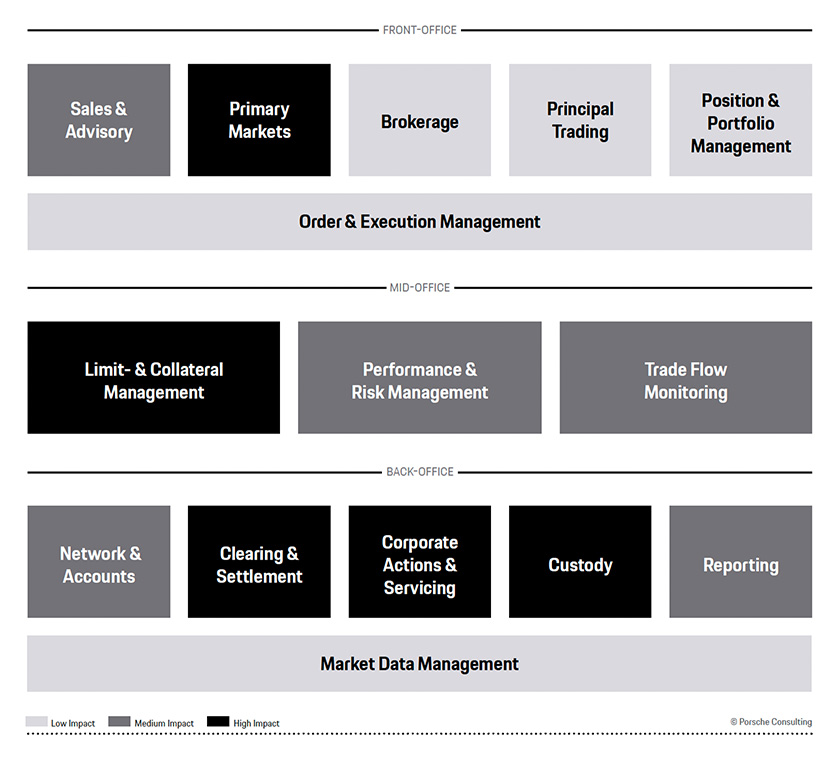

The authors take the approach of describing the traditional structure of a capital market issuance in terms of the functions performed – the roles of front, middle and back office in a real-world asset issuance. See their diagram below:

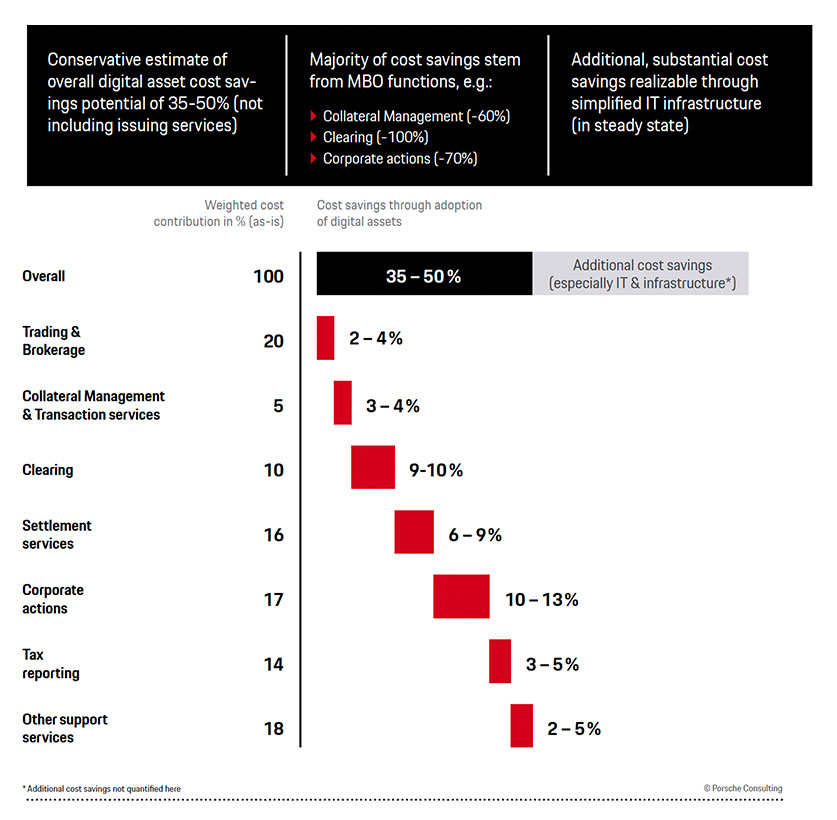

These functions will be familiar to anyone who has worked in traditional financial asset issuance. But the authors use this framework to precisely calculate the achievable cost savings in these functions by scouring the academic literature to gain access to tested metrics. Here is the upshot:

Front Office:

- Tokenisation replaces securitisation, obviating the need for bank and market-maker intermediaries.

- Fractionalisation is facilitated, lowering the entry price to new investor populations.

- Costs reduce because of pared-down digitised processes.

Middle Office:

- With Delivery vs Payment (DvP), settlement time collapses to zero.

- Completely jettisoning settlement and counterparty risk.

- Contributing to transaction speed and lowering associated costs.

Back Office:

- Central Securities Depository (CSD) intermediaries are replaced by more secure blockchain storage.

- Foreseeable corporate events can be programmed into smart contracts (and unforeseeable events can pivot to newer contracts).

- Reporting requirements are delivered naturally out of open and immutable blockchain records.

- Again, we see risk reduction, cost reduction and increased speed.

The paper then breaks down the actual cost savings, the majority of which are found in Middle and Back Office functions (MBO):

Regulation

Because this report was produced by a German company, the section on regulatory benefits has an EU-flavour. In addition to outlining the landscape of crypto-specific regulation in various EU countries, (with Switzerland being the most crypto-progressive), the authors highlight a more important matter. Current regulations for traditional finance simply become non-issues with tokenised securities.

The examples they provide:

- Clearing regulations such as EMIR (European Market Infrastructure Regulation) become obsolete. There is no clearing and settlement on blockchain transactions – They are instantaneous and atomic.

- Depository regulations like CSDR (Central Securities Depositories Regulation) are similarly superfluous with blockchain-lodged assets.

- Trade reporting requirements like MIFID II/MiFIR (Markets in Financial Instruments Directive) are considerably simplified, regulators simply need blockchain explorer tools which reveal the immutable history of asset trading in granular detail.

The report ends with a call to action for all financial players participating in capital markets:

- The underlying DLT of cryptocurrencies holds a disruptive potential and offers promising new value propositions for participants in financial markets.

- Simply ignoring DLT is not an option — companies must develop an holistic digital assets strategy, including the alignment of the operating model as well as possible effects on risk management.

- The various front-, middle-, and back-office use cases provide insights on how to address both opportunities and challenges of digital assets.

- It is crucial to develop a target picture, including the ambition level for digital assets as well as the role digital assets can possibly play regarding the company´s business model.

- Financial institutions must act now and actively formulate entry strategies and evolve along the digital asset learning curve in order to stay competitive.

We couldn’t have said it better ourselves.

Tags

AI AltFi Asset Maturity Blockchain Capital Markets Capital Markets Capital Markets of the Future Investing Mesh Open to all Smart Assets Capital Markets of the Future Commodity Markets Crypto Markets Decentralisation DeFi DieMos ETN Financial Markets FinTech Floating Rate Bond FSP FTX Global Markets Gold Investing Investment Mesh Open to all Regulation Secondary Market Smart Assets Stellar Tokenisation TradFi Webinar

- Blockchain, Capital Markets of the Future, Financial Markets, TradFi

Want to stay in the know on upcoming events and seminars?

Newsletter Sign Up

For more press information, please contact:

Connie Bloem, Product owner of Mesh:

hello@meshtrade.co / +1 604 671 4515