News & Insights / Successful First Tokenised Bond Issuance in Africa

Successful First Tokenised Bond Issuance in Africa

- May 24, 2024

- by Mesh

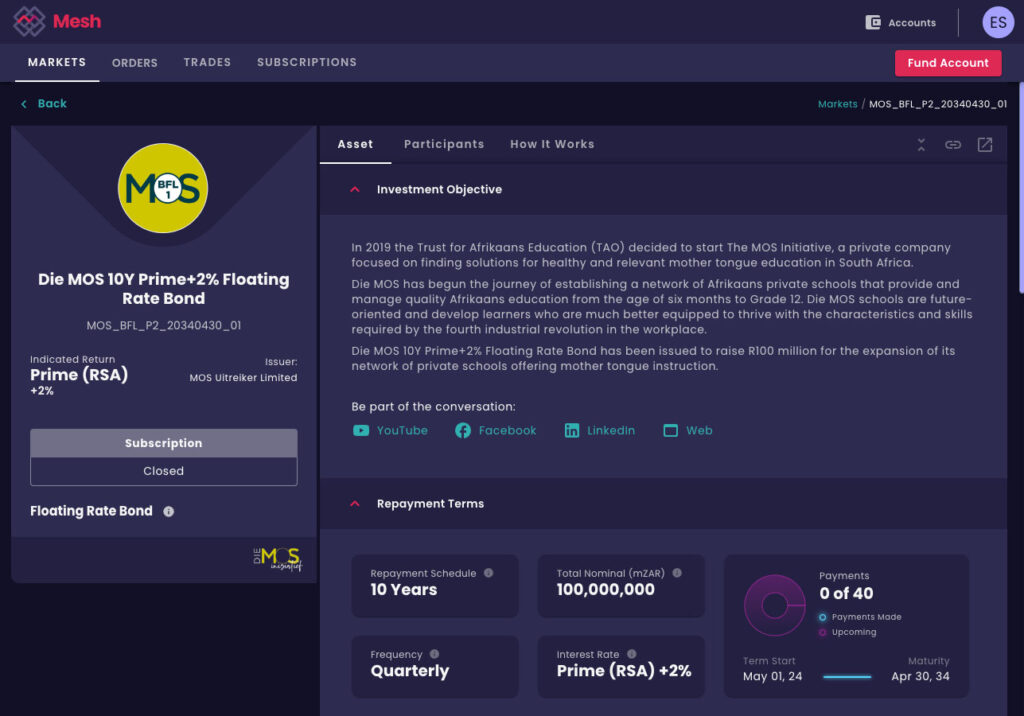

In April 2024, history was made in Africa’s financial landscape as Die MOS Inisiatief, a South African private school network, successfully raised R100 million through a tokenised corporate bond offering on the Mesh platform. Leveraging cutting-edge smart asset technology, this groundbreaking initiative aims to fuel Die MOS’s expansion endeavours, setting a new standard for transparency, efficiency, and accessibility in capital markets.

The MOS bond represents a historic milestone for South African finance and offers a glimpse into the future of global capital markets. Mesh’s platform, underpinned by the Stellar blockchain network, seamlessly integrates every stage of the bond lifecycle, resulting in a more efficient, transparent, and accessible marketplace for issuers and investors alike.

Some 65.5% of the R100 million was raised directly from the public. Of that public raise, 24% came from non-institutional investors, demonstrating how Mesh’s innovative approach makes capital markets more accessible to individuals as well as companies.

For growth-minded executives, the MOS deal’s success demonstrates the real-world potential of the Finance 3.0 approach to funding. By raising capital digitally with Mesh, business leaders can access a broader pool of capital, streamline issuance, and significantly reduce costs, ushering in a new era of financial innovation.

Financial markets are no longer meeting the demands of the digital world

Companies seeking to raise funds face a complex web of regulations, law firms, and service providers, each adding to the overall cost of capital. This cumbersome process constrains flexibility, with smaller enterprises struggling to find willing investors within the time and cost parameters that they require to react to a continuously changing digital world.

Investor demand for a broader range of fixed-income and alternative products continues to grow. However, high minimum denominations, limited liquidity, and slow settlement times put many investments out of reach for most participants.

As these structural limitations persist, the need for a new paradigm in debt capital markets has become clear. Mesh’s blockchain-powered platform offers a compelling solution, enabling businesses to engage directly with lenders and investors in an open and dynamic marketplace.

When a company issues a bond on Mesh, the end-to-end process occurs within the platform’s technology stack, from origination to settlement. Each note is tokenised on the Stellar blockchain enabling secure issuance, trade, settlement and servicing throughout an asset’s lifecycle.

This digitally native asset structure unlocks powerful benefits for issuers. The Mesh Oracle automates key processes like coupon calculations and payments, asset registries and redemptions, minimising manual touchpoints and the risk of human error. Immutable transaction records enhance transparency for all stakeholders, while the elimination of intermediaries such as a separate central securities depository streamlines the process.

For investors, fractional ownership dramatically reduces minimum investment sizes, opening access to a much wider user base. Instant settlement enables unprecedented liquidity, allowing investors to react swiftly to market changes and optimise their allocation.

Mesh’s easy-to-use platform puts issuers in full control, enabling them to structure deals, set auction or subscription terms, and distribute assets to a global network with just a few clicks. Real-time dashboards and a unified data architecture ensure that all parties work from a single source of truth, enhancing transparency and facilitating better decision-making.

With a target size of R100 million, a two-week bookbuilding window, and a minimum denomination of R5 000, the offering attracted a diverse pool of investors. TAKKE, a Trust focused on Education, Arts and Culture, provided underwriting and a guarantee for the raise, providing investors with an extra layer of security.

The issuance response was very positive, with broad participation from small retail buyers to larger high-net-worth investors, from small companies to large institutions. Investors praised the accessible, efficient digital bond experience, with the platform’s speed and ease of use drawing in many first-time bond investors.

The bond raised its targeted R100 million in five weeks, with 65.5% coming from the public and the balance from the underwriter. Some 24% of the public raise came from non-instutional investors (72% of them individuals, and 28% companies). In total, 13 106 tokenised notes were issued.

Conclusion

The issuance of the MOS bond carries significance that extends far beyond one company or geography. By proving the viability and advantages of digitised debt securities, Mesh and MOS have opened the doors to a new era of financial markets. As Finance 3.0 reshapes the debt capital markets landscape, Mesh is committed to enabling this transformation.

The future of open capital markets is here, built on Mesh. Corporate leaders face a choice: cling to yesterday’s intermediated capital markets or embrace tomorrow’s faster, fairer, and more open ecosystem. For visionary executives, the smart choice is clear.

Tags

AI AltFi Asset Maturity Blockchain Capital Markets Capital Markets Capital Markets of the Future Investing Mesh Open to all Smart Assets Capital Markets of the Future Commodity Markets Crypto Markets Decentralisation DeFi DieMos ETN Financial Markets FinTech Floating Rate Bond FSP FTX Global Markets Gold Investing Investment Mesh Open to all Regulation Secondary Market Smart Assets Stellar Tokenisation TradFi Webinar

Want to stay in the know on upcoming events and seminars?

Newsletter Sign Up

For more press information, please contact:

Connie Bloem, Product owner of Mesh:

hello@meshtrade.co / +1 604 671 4515