News & Insights / Q2-25: Calm on the surface

Q2-25: Calm on the surface

In this excerpt from Λnßro Capital Investments’ quarterly newsletter, Chief Investment Officer Craig Antonie looks back on a tumultuous quarter and unpacks what it means for investors.

- July 8, 2025

- by Mesh

If you had gone to sleep on 31 March and woken up on 1 July to check how markets had fared and to catch up on what was going on in the world, you’d think it was a yawn fest. News headlines on 1 July may have raised an eyebrow, but, in all likelihood, you’d just turn over and go back to sleep again.

What you would have missed, however, was an incredibly volatile three months, with significant turbulence in equities, currencies, bonds, and commodities. Markets had been trading cautiously and were trending lower into the end of March. The S&P 500, for example, was down about 4.6% as we ended Q1-25. The fireworks really started, however, just as the quarter began, on 2 April after President Trump’s “Liberation Day” tariff announcements. Within the first week of April, it sank further and had at its low fallen roughly 20% from its February highs, straight into bear market territory.

The tariff wars accelerated with significant pushback from Canada kicking things off. Chinese retaliatory tariffs then sparked fears of an intense global trade war, which sent markets everywhere tumbling. On 9 April, however, the US paused reciprocal tariffs for a 90-day period on all countries except China, whose were in fact raised further in response to their retaliation. This pause, which allowed for a period of negotiations, sparked a market rebound. Since then, US-China agreements in Geneva and the UK calmed nerves further and markets continued to move higher.

It doesn’t end there. Let’s not forget about the ongoing war in Europe and then the escalation in the conflict between Israel and Iran on 13 June, which drove oil prices sharply higher. The conflict had the potential to go global after the US struck key assets in Iran; however, after an attack of US airbases in Qatar in response, both sides sought de-escalation through diplomacy which culminated in a ceasefire agreement in the region on 24 June. By then oil prices had begun falling again, markets had stabilised, and lo and behold: by the end of the quarter record highs were once again on the cards. Not only had the markets recovered the first quarter loss of around 4.6%, but they had retraced the entire 20% peak-to-trough drawdown. The S&P 500 ended Q1 at -4.6% and by Q2 it was +4.96%.

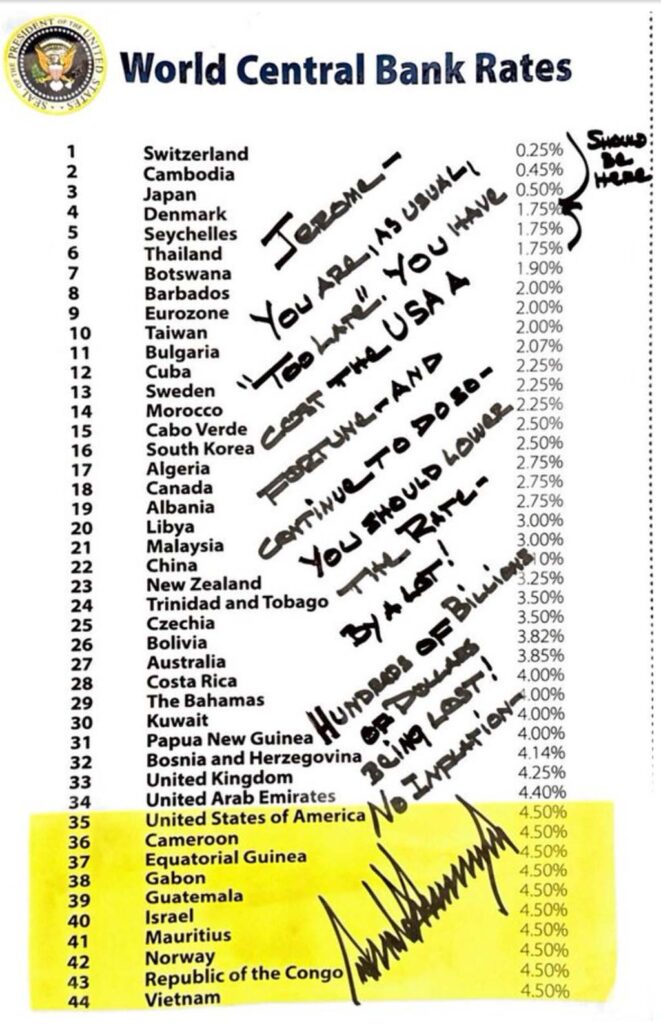

We haven’t even touched on things like the internal battle the US President is waging on the Chair of the Federal Reserve, Jerome Powell, and the intense pressure being put on the central bank to cut rates. It was even followed by a handwritten note that President Trump had etched to Powell calling him “too slow” and accusing him of costing the country hundreds of billions of dollars as a result.

Looking Ahead

From a markets perspective, we’re once again in a place where valuation is being questioned, economic data is being closely scrutinised and of course many issues around tariffs and tariff deals have not been resolved yet. The problem many investors have faced over the past quarter has been a massive whipsawing of market prices based primarily on headlines and with no factual basis on actual corporate performance. Quarter 1 performance data for the S&P 500 showed year-over-year earnings growth of 13.4% and revenue growth of 5.7%. According to FACTSET, of the companies that have issued guidance for Q2 earnings, more than average have leaned positive.

With the tariff axe still hanging over us, it is likely that as we get closer to the expiry of the 90-day pause, markets will look for clarity around either a resolution or a further extension. A worst-case scenario would be no deals, no extension, and a reversion to Liberation Day tariff levels!

Quarter 2 earnings season will be watched closely too. Investors will want to see what the impact of the tariffs have been so far on corporate results and company outlooks. For the time being, it’s been a non-event and still too early to tell. If inflation remains contained, it’s likely the Fed will resume rate cuts and perhaps be even more aggressive than currently expected. There is an argument to be made that they are behind the curve when compared to other countries and regions. The US economy has held up very well so far and there is a lot of room for the Fed to move if things go downhill quickly.

What this means for the Λnßro portfolios

The Λnßro Dynamic Compound portfolio, with its current dollar dividend yield of 3.45%, ended the quarter up 7.38% in USD (YTD up 14.25%). In ZAR, the quarterly return was 3.72% with a YTD return of 7.68%. The portfolio performed very well during the quarter. The flow of funds into European Markets post the Liberation Day tariff announcement boosted returns. The portfolio is weighted at over 60% in Europe/UK/Switzerland. Standout sectors were Utilities, Technology, and Industrials. Individual gainers and decliners YTD are as follows:

AnComp*

Sector | Top 5 | Bottom 5 | Sector |

|---|---|---|---|

Utilities | BAE Systems | United Health | Health Care |

Insurance | Prudential Plc | Blue Owl Capital | Financials |

Utilities | E.ON | Equinix | Real Estate |

Insurance | Aviva Plc | PepsiCo | Consumer Staple |

Health Care | HCA Healthcare | Blackstone | Financials |

*YTD performance |

As a reminder, this portfolio is positioned in such a way that lower interest rates and/or a risk-off market will provide support to the underlying companies here. We view it as the more conservative of the strategies we run.

The Λnßro World’s Biggest Brands portfolio rose by 11.32% in USD in Q2 (YTD up 6.14%). In ZAR, the quarter saw gains of 7.48% (YTD FLAT). The portfolio was rebalanced during the quarter, with a few notable changes made. What investors might find interesting here is that more traditional companies such as BMW, Anheuser Busch, DHL, Gucci, HSBC, and Vodafone fell out of the portfolio at the expense of more “modern”, newer companies such as XIAOMI, Spotify, Bookings.com and DoorDash, with the first two immediately rocketing to the top of the performance list. Apple and Salesforce are two interesting names at the bottom end of performance, whilst Louis Vuitton is still battling to find traction this year.

BRNDZ*

Sector | Top 5 | Bottom 5 | Sector |

|---|---|---|---|

Information Tech | Xiaomi | United Health | Health Care |

Communication Services | Spotify | Tesla | Consumer Discretionary |

Industrials | UBER | LVMH | Consumer Discretionary |

Consumer Staples | Philip Morris | Salesforce | Information Tech |

Consumer Discretionary | MercadoLibre | Apple | Information Tech |

*YTD performance |

This is considered a high quality, diversified, global portfolio by the team at Λnßro. It sits in the middle of the risk spectrum of the strategies we run.

The Λnßro Unicorn Growth portfolio jumped by 17.35% in USD in Q2 (YTD up 5.31%). In ZAR, the quarter saw gains of 13.32% (YTD down 0.75%). As the markets rebounded post the 90-day tariff pause the portfolio took off from its lows. The growth sectors, specifically Technology, rebounded by 22% over the quarter. Earnings from stalwarts in the Tech space were also very strong. The MAG7, for example, shot the lights out with earnings growth of 27.7% for the quarter far surpassing the 16% consensus. This reignited the AI trade and from being the laggards in Quarter 1, this theme came roaring back in Quarter 2!

Unicorn*

Sector | Top 5 | Bottom 5 | Sector |

|---|---|---|---|

Consumer Staple | Celsius Holdings | The Trade Desk | Communication Services |

Communication Services | MercadoLibre | Cellebrite | Information Tech |

Information Tech | CrowdStrike | Manhattan Ass | Information Tech |

Consumer Discretionary | DoorDash | Tesla | Consumer Discretionary |

Health Care | Veeva Systems | HubSpot | Information Tech |

*YTD performance |

The Λnßro team sees this portfolio as the one that offers the highest growth and blue-sky potential. It suits long-term investors looking to buy a piece of companies that offer massive long-term upside. It is by far the most ‘exciting’ portfolio we run and certainly the most volatile too. It earns its place in a diversified portfolio via its potential for life-altering returns.

The Λnßro TITANS Core portfolio was launched as an AMC toward the end of May 2025. The AMC returns since launch have been 1.26% in USD and 2.6% in ZAR.

TITANS**

Sector | Top 5 | Bottom 5 | Sector |

|---|---|---|---|

Utilities | VistraCorp | Equinix | Real Estate |

Information Tech | Nividia | McDonalds | Consumer Discretionary |

Industrials | UBER | Costco | Consumer Staple |

Industrials | Caterpillar | Sherwin-Williams | Materials |

Industrials | JP Morgan | Tesla | Consumer Discretionary |

*YTD performance |

This core portfolio should be compared to the S&P 500 from both a returns and risk perspective over the long term. Any investor who invests in or has considered an S&P 500 tracker fund for their core holding could do well by considering the TITANS portfolio instead.

Onward

As we advance into the latter half of 2025 and the summer season in the northern hemisphere, markets remain stable, near record highs. We anticipate an eventful three months ahead, filled with news flow, results, economic data, and the accompanying market fluctuations. Our hope is that this period will bring a measure of calm on both the geopolitical and economic front. Nevertheless, as long-term, forward-thinking investors, we are prepared to navigate whatever challenges the market presents.

If anything, this quarter has once again shown me how the discipline of long-term investing, coupled with regular contributions, can smooth out returns and reduce anxiety – especially during times of volatility.

Tags

27Four AltFi Blockchain Capital Markets Capital Markets of the Future Commodity Markets Crypto Markets DeFi DieMos ETN Financial Markets FSP Fully backed stablecoin Global Markets Gold Investing Investment Mesh mZAR Open to all PreciousMetals Private Equity Regulation Secondary Market Silver Smart Assets Tokenisation TradFi Yield-bearing stablecoin yZAR ZAR stablecoin

- Capital Markets, Commodity Markets, Financial Markets, Global Markets, Investing, Investment, Mesh

Want to stay in the know on upcoming events and seminars?

Newsletter Sign Up

For more press information, please contact:

Connie Bloem, Product owner of Mesh:

hello@meshtrade.co / +1 604 671 4515