- Issuers

- Investors

- Services

Features and tools

Services and rules

Features and tools

Services and rules

- Company

- News & Insights

News & Insights / The tokenisation of Real World Assets

The tokenisation of Real World Assets

Gathering Speed

- October 5, 2023

- by Mesh

In the last 5 months since Mesh announced its successful Series A funding round from Convergence Partners, the global snowball of real-world-asset tokenisation projects has accelerated at a dizzying rate, with press releases and partnership announcements now happening almost daily. And while Mesh was one of the earliest evangelists and builders in this sector, the rest of the world seems to have passed its tipping point, with everyone from old guard to new disruptors looking to carve out a piece of this tokenisation turf.

We have, in the past, chosen some of the most impactful announcements to explore and publish (and will continue to do so), but we thought it would be a good idea to pause for a second and try to get a high-level view, because context is everything.

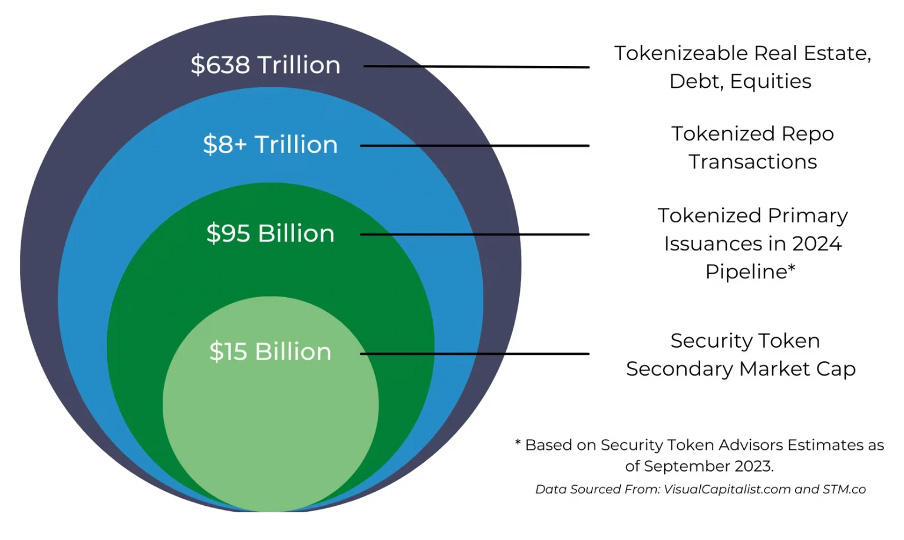

First off, let’s take a look at the total market size. How many assets in the world are potentially tokenisable? In short, a lot:

There are two notable data points here. The first is the $95bn in the tokenised Primary Issuances pipeline. This number is up from essentially zero before the pandemic. The second even more interesting point is the $15bn market cap of the ‘Secondary Market’. Who are these people? They are mainly retail, crypto-literate investors who are actively trading or holding tokenised assets.

Not institutions, not corporates. Just regular investors, who are comfortable in the cryptoverse. This is a massive growth market as more and more end-consumers become comfortable with travelling through the digital world and taking advantage of the sort of returns that were previously only available to those in-the-know, in the great towers of finance.

Digging a little deeper into the total numbers, we find that one somewhat surprising class of tokenised asset has emerged quickly and frictionlessly. Why surprising? Because of its lack of sex appeal. It is money markets and treasuries. Those are low-risk and relatively low-yield instruments, designed to satisfy the needs of cautious investors who want safety and liquidity.

Given the historically high-interest rate being offered by these instruments right now, a killer investor pool has emerged. This is those crypto-travelers sitting on stablecoins. These coins used to attract no interest at all, but if they are swapped out for tokenised on-chain T-Bills, for instance (currently yielding over 5%), you have a perfect match of assets and investor appetites.

How big is this retail low-risk/low-return market? It has grown from nothing to $650m in two years, according the to the real-world-asset tokenisation analytics site RWA.xyz (and this does not include institutional primary issuances – this is almost all retail).

There is nothing fancy here – no complex private capital backstories and founders’ CVs and business plans and credit data to be studied and evaluated. Just good old money markets and government debt being made available to a fleet of crypto investors who wish to get some returns on their stablecoin holdings as they wait for new opportunities in AltFi assets, or other crypto projects. And compare that $650m to the size of the entire market in the previous graphic, and you can hear the rumblings of the coming growth explosion.

If we add both institutional and secondary market private capital tokenisation activity to the treasury/money market tokenisation activity, there is over worth $10bn of token issuances in the hands of primary or secondary investors (Source: MarketsandMarkets Research Private Ltd

So who else is playing in the space which Mesh started building in 2019? Well, almost everyone now – JPMorgan with their Onyx division, HSBC with their Orion division, Société General with their SG-Forge division. And UBS, Santander, European Investment Bank, ABN AMRO, Union Investment, Singapore Monetary Authority, Bank of Japan. Anywhere you care to look, really.

But there is one that stands out, so we want to end with that. It concerns an asset known as a HELOC (Home Equity Line of Credit) – a long and established traditional finance product.

Earlier this year a $237 million blockchain-based, tokenised HELOC was underwritten by Goldman Sachs, JPMorgan and Jeffries and deployed by Figure Technologies on the private Provenance blockchain.

Why was this a big deal? Because it was the first blockchain HELOC issuance to have received a rating, its Class A note receiving a AAA rating from DBRS Morningstar. This, in the words of Figure Technologies CEO Mike Cagney “is an inflection point in capital markets”.

Once the famously cautious ratings agencies relax, then you can be sure that a torrent of investors is not far behind.

Tags

- AltFi, Capital Markets of the Future, Investing, Mesh

Want to stay in the know on upcoming events and seminars?

Newsletter Sign Up

- Pending Fresh Sign Up Form

For more press information, please contact:

Connie Bloem, Product owner of Mesh:

hello@meshtrade.co / +1 604 671 4515