Own the places people actually shop.

Tokenised equity in a convenience retail centre portfolio, with a strong development pipeline.

Why this, why now?

Convenience retail, a segment that’s historically proved more stable than big malls, focusing on groceries, pharmacies, health & beauty, and daily essentials.

Dorpstraat Property Investments (DPI) presents an equity investment opportunity in a specialist unlisted property fund, through strong-performing, low-risk convenience shopping centres located in some of South Africa’s most dynamic urban and peri-urban nodes.

Through 27fourDPI on Mesh, qualified investors can now buy tokenised equity in this convenience retail portfolio.

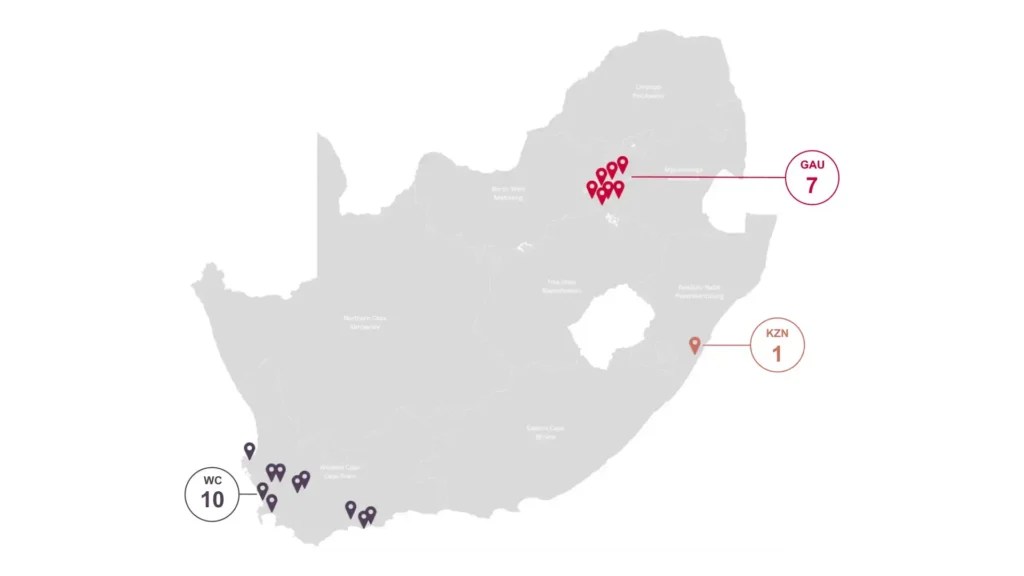

Dorpstraat Property Investments (DPI) is a curated portfolio of 17 convenience retail centres located in affluent, high-growth nodes. These centres, typically between 5,000m² and 15,000m², are the backbone of the “daily needs” economy. They are where people stop for milk, pick up a prescription, or grab a quick coffee.

The Power of the Portfolio

Unlike a single-property investment, DPI offers built-in diversification. With 9 centres already trading and 8 in the construction phase, the DPI property portfolio balances immediate cash flows with future capital growth.

Investment Highlights

Defensive Demand

Centres anchored by household-name tenants that cater to consumers’ daily needs, not luxuries.

De-risked development

Projects target ≥65% pre-let before construction starts. With a focus on high-income catchment areas.

Seasoned sponsors

Dorpstraat’s specialist retail track record is extensive, alongside a group of trusted institutional co-investors and bank partners.

Targeted outcomes

DPI’s strategy prioritises capital growth to a defined exit horizon (projected Dec 2029).

Access to unique private assets

Invest in institution-grade assets in smaller tickets, manage holdings in one place, and view updates on Mesh.

Investment Structure

Purpose of investment

Equity Investment in national portfolio of “convenience retail” centres .

Investment amount

Minimum of

R1,000,000*

Term of investment

~4 years

Investment vehicle

Equity ownership in 27fourDPI (Pty) Ltd

Platform

Mesh Trade

*Investment subject to qualified investor eligibility, as disclosed in offer documents. Returns are not guaranteed.

What you’re investing in

A curated portfolio and pipeline of convenience or neighbourhood shopping centres in growth nodes (Western Cape & Gauteng focus), anchored by leading grocery and healthcare brands.

The DPI Strategy: Acquire and develop at cost -> optimise -> exit.

No interim income. All new projects target strong pre-lets and disciplined CAPEX.

Investment Opportunity

27four Capital Partners presents a compelling investment opportunity for qualified investors, in DPI , which holds a 20% stake in Dorpstraat Capital Growth Fund (DCGF).

DCGF focuses on convenience shopping centres in affluent neighbourhoods, anchored by blue-chip tenants like Woolworths, Pick n Pay, Checkers, SPAR and Clicks. Known for hands-on management, Dorpstraat creates resilient, attractive retail destinations across economic cycles.

The investment offers exposure to both existing stabilised assets and a robust development pipeline of 7-10 new properties through 2026, with an optional exit planned for December 2029.

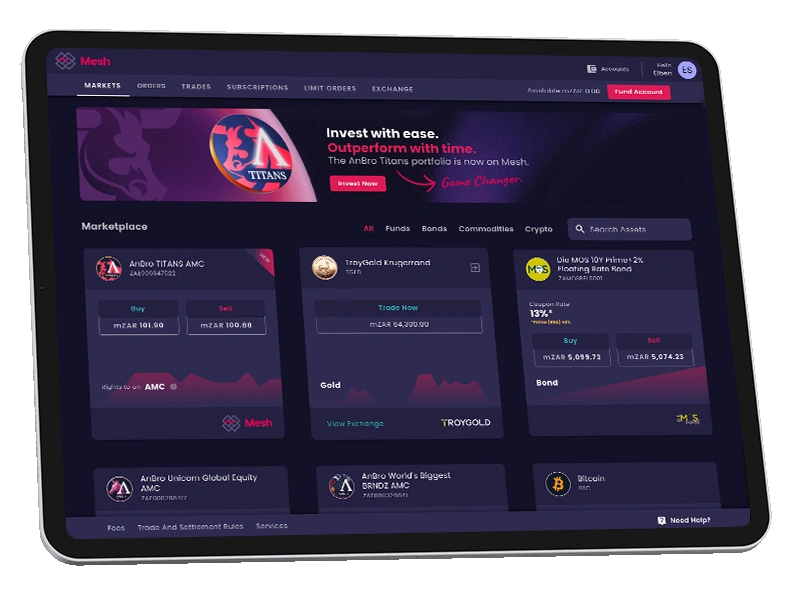

Mesh-Enabled Access and Liquidity

Investors will be issued tokenised shares via Mesh, a secure digital investment platform that enables direct participation in curated, non-exchange-listed opportunities such as this, providing streamlined access, transparency, and ease of engagement.

- Transparent Investing: Real-time dashboards, secure smart contracts, and quarterly audited reporting.

- Secondary Market: Potential to trade a portion of your holdings on the Mesh Secondary Market, adding flexibility to a traditionally illiquid asset class.

- Automated Compliance: Smart contracts manage ownership, distributions and transfer approvals.

How It Works

Subscribe via app.Mesh.trade to acquire tokenised shares in 27fourDPI (Pty) Ltd.

Own tokenised equity in the Dorpstraat Property Investments portfolio, with rights and distributions managed by smart contracts.

Benefit from long-term capital appreciation as the property values rise

Seize the Opportunity

DPI focuses on neighbourhood centres, offering grocery, pharmacy, health & beauty. These assets are built around daily spend, not discretionary luxury.

New developments target ≥65% pre-lets before build. Anchor alignment, disciplined capex, and specialist asset management help drive value creation to a defined exit horizon.

Read the offer documents, view the property portfolio pipeline, and see how access to tokenised equity makes allocation simple.

Invest alongside 27four, Remgro, PHG and Dorpstraat, South Africa’s leading real-estate investors, to secure inflation-protected income and compelling long-term capital growth.

The information on this page is for awareness and education only and does not constitute (and should not be construed as) an offer, invitation, or solicitation to buy or subscribe for any securities or other financial products. Any opportunity referenced will only be made available (if at all) under the full investor documentation, and only to investors who meet eligibility requirements and are accepted in terms of those documents. Where a tokenised security is used, the investor holds a token that represents the underlying security, with rights as set out in the investor documentation.