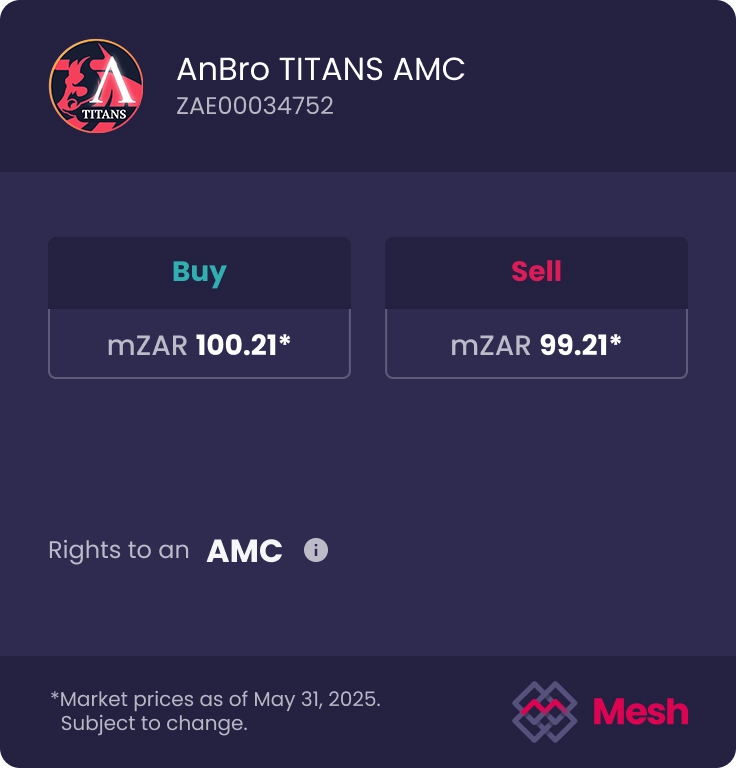

Asset Overview

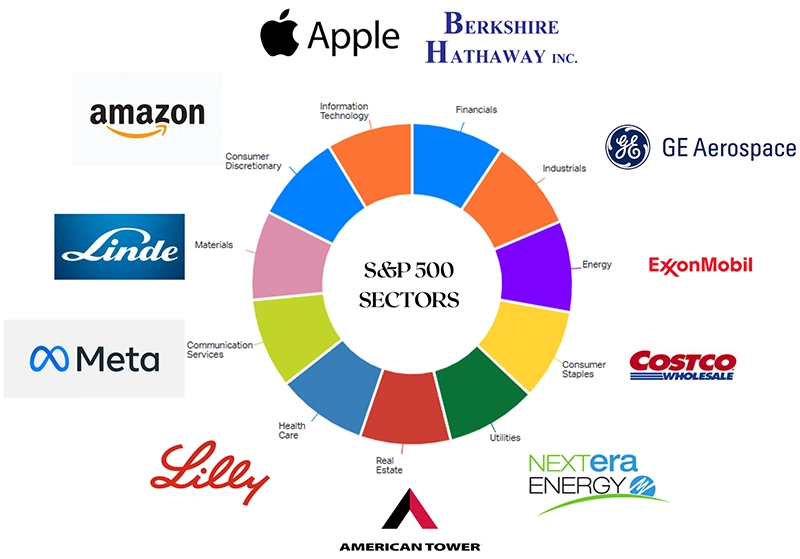

The AnBro Titans AMC is a carefully constructed portfolio of the most powerful and dominant companies across the 11 sectors of the S&P 500. These companies have earned their place at the top through consistent performance, global relevance, and financial resilience.

This is not just an equity strategy, it’s a commitment to scale, liquidity, and stability. With equal weighting and broad diversification, the Titans portfolio offers investors a balanced exposure to the world’s most elite corporate performers.

Investment Strategy:

The AnBro Titans AMC invests in large, battle-tested companies that lead their industries and have proven resilient across market cycles. Using an equal-weighted, annually rebalanced structure, the portfolio avoids mega-cap bias, captures sector-specific alpha, and offers a disciplined, lower-risk alternative to traditional passive S&P 500 ETFs.

Investment Objective

The AnBro Titans portfolio aims to generate long-term capital growth by investing in sector-leading companies that consistently deliver strong shareholder returns, stable dividends, and lower volatility than the broader S&P 500.

Identifying the Industry Titans

Using their proprietary model, AnBro identifies the strongest companies in each of the 11 GICS-defined sectors that drive the US economy. Each stock is evaluated for profitability, growth, market leadership, financial stability, and size. Final selections are filtered further by metrics like volatility and long-term return consistency to ensure only the highest quality stocks are included.

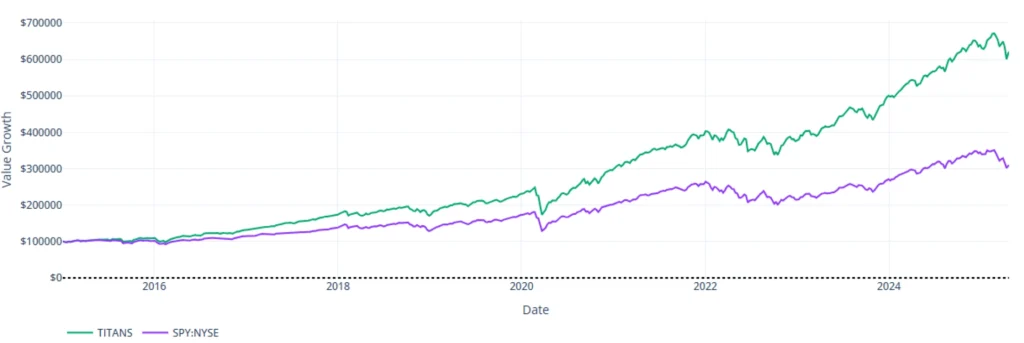

Portfolio Performance

This portfolio has been part of the AnBro stable for several years, as a large-cap offering to a select group of private clients.

Unlike market-cap-weighted ETFs, the Titans AMC gives equal weight to the top-performing stock in each sector, providing balanced exposure and reducing concentration risk.

This approach helps the fund adapt to shifting market conditions, benefiting from growth sectors in rallies and defensive sectors in downturns. Annual rebalancing keeps the portfolio aligned with changing market leadership while maintaining low turnover and tax efficiency.

Why invest?

This portfolio has grit and could easily form the cornerstone of any investor’s long term assets. Its appeal is diverse, and it is attractive across the risk spectrum.

- Growth-Oriented Investors: Equal weighting amplifies the impact of mid- and large-cap outperformers in growth sectors like Technology and Consumer Discretionary, which may be underrepresented in market-cap-weighted indices.

- Risk-Conscious Investors: Risk is mitigated via equal weighting and sector diversification, which reduces volatility compared to concentrated or market-cap-weighted strategies.

- Income-Focused Investors: Benefit from dividend contributions from top stocks in defensive sectors like Utilities and Consumer Staples. The equal weighting ensures income is not overly reliant on a few high-yield stocks.

- Tactical Investors: This is a core holding that benefits from sector rotation, with annual rebalancing ensuring alignment with economic cycles (e.g. favouring Industrials during recoveries or Health Care during uncertainty).

For more information on this portfolio and how it works, click the button below to view our FAQ section.

Portfolio Specifics

Investment Focus:

Actively managed global equities and currency exposure

Class Launch Date:

Investment Term

Suggested

(long-term)

Benchmark:

S&P 500

Risk Rating:

High

ISIN Number :

ZAE000347522

JSE Share Code:

TITANS

Asset FAQ's

A Titan is a company that:

- Leads its industry by market capitalisation, resilience, and performance.

- Operates across multiple geographies and is globally relevant.

- Has demonstrated sustained success through various economic cycles.

- Offers deep liquidity, allowing for smoother trading and reduced volatility.

Examples of such companies include Apple Inc., with a market cap of over USD 3 trillion, and Take-Two Interactive, one of the smallest by weight in the portfolio but still highly liquid.

The portfolio is:

- Equally weighted across the top company in each of the 11 S&P 500 sectors.

- Selected using proprietary screening tools designed by AnBro Capital Investments.

Built to be diversified, reducing risk from overconcentration in any one sector or stock.

While past performance is not indicative of future results, the Titans strategy has a strong historical track record. It has:

- Outperformed during various downturns (2016, 2018, 2020, 2022).

- Maintained lower volatility than the S&P 500 over the past decade.

- Shown better Sharpe and Sortino ratios than the S&P 500.

- Diversification: No single sector or stock dominates the portfolio.

- Global Exposure: Many companies operate in both developed and emerging markets.

- Liquidity: All constituents are highly liquid, enabling efficient entry and exit.

- Blue Chip Quality: Composed of established, well-managed global leaders.

- Cornerstone Potential: Ideal as a foundational portfolio component or as part of a broader investment strategy.

The Titans AMC is managed by a seasoned team at Anbro Capital Investments, led by Craig Antonie (Chief Investment Officer), alongside Justiné Brophy (Chief Executive Officer) and Lloyd Priestman (Director & Portfolio Manager). Together, they bring decades of financial market experience, both locally and internationally.

AnBro Capital Investments is a proud recipient of:

- SALTA Award (2022): Total Return Performance – 3 years

- SALTA Award: Foreign Equity Trading Efficiency

These accolades speak to the firm’s ability to design and manage high-performing investment products.