Why Van Rijn Meent?

Own a piece of a best-in-class, mixed-use precinct in Stellenbosch’s historic centre.

The iconic Van Rijn Meent precinct is located on one of the last, large developable sites of this calibre in Stellenbosch.

It is a rare opportunity for long-term capital growth and reliable income.

Rare opportunity to invest in one of the few remaining development sites in central Stellenbosch.

Traditionally, a project of this calibre would be funded entirely by a handful of institutional giants. When made available through Mesh, any participation is structured as a private placement and is limited to eligible investors in accordance with the applicable investor documentation.

Investment Highlights

27four is seeking to raise up to R64 million to co-invest in the development of Van Rijn Meent from various pools of capital, including high-net-worth individuals, family offices, institutional investors and other eligible qualifying investors. As a demonstration of confidence and alignment of interest, 27four is contributing its own capital alongside other investors.

Strategic Location

Corner of Dorp Street & Stellentia Road. High foot traffic, iconic neighbours and rapid Western Cape “semigration” tailwinds.

Blue-Chip Anchor Tenants

46% of commercial space is already under 10-year leases to Investec, Checkers and Clicks, anchoring stable cash flows.

Mixed-Use Diversification

2 800 m² premium offices

3 500 m² retail and dining

A 125-unit Aparthotel, under TPF Hospitality management.

Top-Tier Partners

Developed by Dorpstraat Properties with co-investors 27four, Remgro and PHG. A powerhouse team, combining local expertise, governance and capital.

Market Momentum

Stellenbosch commands South Africa’s highest office-rental growth and lowest vacancies, driven by:

Stellenbosch Growth:

Benefits from Western Cape “semigration,” student and faculty population, and sustained wine-tourism demand.

Hospitality Surge:

82.7% peak occupancy in Feb 2025 across the region.

Boutique hotels and aparthotels commanding 8–9% yields.

Diversified Economy:

Resilient Western Cape economy vs. national headwinds.

Education, tech, agriculture, tourism, sport and professional services underpin stable, long-term property values.

Capital Growth Potential

Due to the premium status of the location, strong tenant profile and the high demand for commercial space in Stellenbosch, we expect the rate of capital growth to exceed that of the overall SA property market.

Risk Management & ESG

Conservative Leverage:

60% senior bank debt / 40% equity

Optimises cost of capital and limits refinancing risk

Governance Committee:

Representatives from each sponsor monitoring budgets, timelines and key milestones.

Recovery Protections:

Statutory levy hypothecation and transfer embargoes secure tenant payments.

Insurance Support:

Capital-value cover on aparthotel receivables and performance guarantees for construction.

Sustainability Measures:

Water-efficient landscaping, energy-saving design and community engagement in line with basic ESG standards.

Investment Structure

Purpose of investment

Equity Investment in property development in Stellenbosch

Investment amount

Minimum of

R1,000,000*

Term of investment

~10 years

Investment vehicle

Equity ownership in 27four VRM (Pty) Ltd

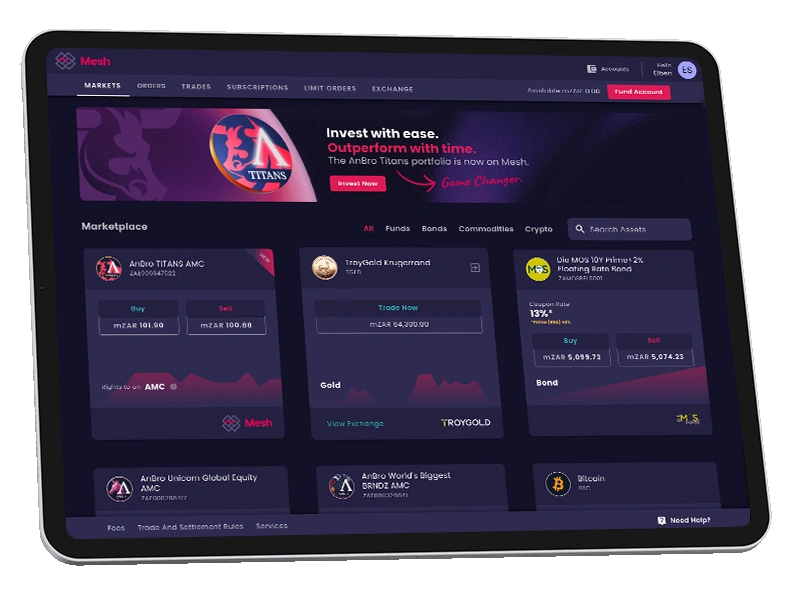

Platform

Mesh Trade

*Investment subject to qualified investor eligibility, as disclosed in offer documents. Returns are not guaranteed.

Mesh-Enabled Access and Liquidity

Investors will be issued tokenised shares via Mesh, a secure digital investment platform that enables direct participation in curated, non-exchange-listed opportunities such as this, providing streamlined access, transparency, and ease of engagement.

- Transparent Investing: Real-time dashboards, secure smart contracts, and quarterly audited reporting.

- Secondary Market: Potential to trade a portion of your holdings on the Mesh Secondary Market, adding flexibility to a traditionally illiquid asset class.

- Automated Compliance: Smart contracts manage ownership, distributions and transfer approvals.

How It Works

Subscribe via app.Mesh.trade to acquire tokenised shares in 27fourVRM (Pty) Ltd.

Own tokenised equity in the Van Rijn Meent DevCo, with rights and distributions managed by smart contracts.

Benefit from long-term capital appreciation as the property stabilises and regional values rise.

Seize the Opportunity

This offer provides direct equity in Stellenbosch’s next iconic landmark, a high-quality mixed-use development, underpinned by long-term leases and a prudent capital structure.

Invest alongside 27four, Remgro, PHG and Dorpstraat, South Africa’s leading real-estate investors, to secure inflation-protected income and compelling long-term capital growth.

The information on this page is for awareness and education only and does not constitute (and should not be construed as) an offer, invitation, or solicitation to buy or subscribe for any securities or other financial products. Any opportunity referenced will only be made available (if at all) under the full investor documentation, and only to investors who meet eligibility requirements and are accepted in terms of those documents. Where a tokenised security is used, the investor holds a token that represents the underlying security, with rights as set out in the investor documentation.